Paytm case study

Paytm creates a social payment experience with Sendbird

Paytm

Founded in 2010, Paytm is India’s leading financial services company that offers full-stack payments and solutions to consumers, offline merchants, and online platforms. Paytm’s mission is to bring half a billion Indians into the mainstream economy through payments, ecommerce, banking, investments, and financial services.

In March 2021 alone, Paytm recorded over 1.4 billion transactions. With over 21 million merchant partners on board, the company currently maintains India's highest market share in offline payments. In addition, it is the only platform in the country that promotes all digital payment services, including Paytm Wallet, Paytm UPI, Paytm Postpaid, cards, and net banking.

"The MVP bar for chat is so high that we would have to invest significant resources with this product complexity, this feature complexity of real-time messaging… along with our existing complexities, Sendbird really offloaded all of that from us."

Abhishek Madan, Head of Product at Paytm

Business challenge

Paytm saw in-app chat as a potential game changer in increasing user engagement and satisfaction. Given this climate, Paytm’s product team sought to innovate its user experience further and explore how it could better serve the millions of customers using the platform every day.

Traditionally, Paytm has viewed transaction history as simply a chronological list of payment records. However, the company wanted to address three different pillars and bring them to the forefront of the company’s money transfer interface:

- Identity (whom users are paying)

- Context (why users are being paid)

- Distribution (a payment ecosystem between users, businesses, partners, etc.)

Why Paytm chose Sendbird for in-app messaging

Paytm understood that building chat messaging in-house would be an incredibly complex task. Payments would come from multiple service channels such as Paytm UPI, Paytm Wallet, Paytm Postpaid, Paytm Payments Bank, and more. Paytm Insider Head of Product Abhishek Madan says,

“All of these are presented in the same user experience. These are completely separate backends that have nothing to do with each other, and we attempt to bring all of this data and show it in one place. It’s a massive tech complication.”

Furthermore, due to each product's heavily regulated nature, developing chat in-house in-house would also be an immense compliance undertaking. Madan emphasizes that product managers must oversee chat for the company’s lending insurance and equity trading businesses. All of these UX require us to work closely with compliance teams. Three years ago, each product was a standalone company.”

With the sheer scale of Paytm’s user base and its breadth of offerings, the company needed a service that could offload the complexity and resources necessary to set up a high-functioning chat interface. At the same time, it offers the features customers desire. With Sendbird, Paytm could concentrate on developing its core money transfer features and go to market quickly without the burdens of developing chat functionality.

“The MVP bar for in-app messaging is so high that we would have to invest significant resources in this product complexity, this feature complexity of real-time chat messaging,” Madan explains, “along with our existing complexities, Sendbird offloaded all of that from us.”

Results

Across its service suite, Paytm supports more than 333 million users and, in partnering with Sendbird, has sent over 1 billion messages to date. This scale is supported by the Sendbird Chat API, which has given Paytm the building blocks necessary to create many of its rich chat features and chat UI used today. Madan states, “When you think about Paytm, we’re pretty wide… We have many apps, and thanks to the Sendbird Chat API, I can build walled gardens that I can deploy into each. So, the work I do once is reusable by every business unit inside Paytm. So Sendbird’s platform is a massive help.”

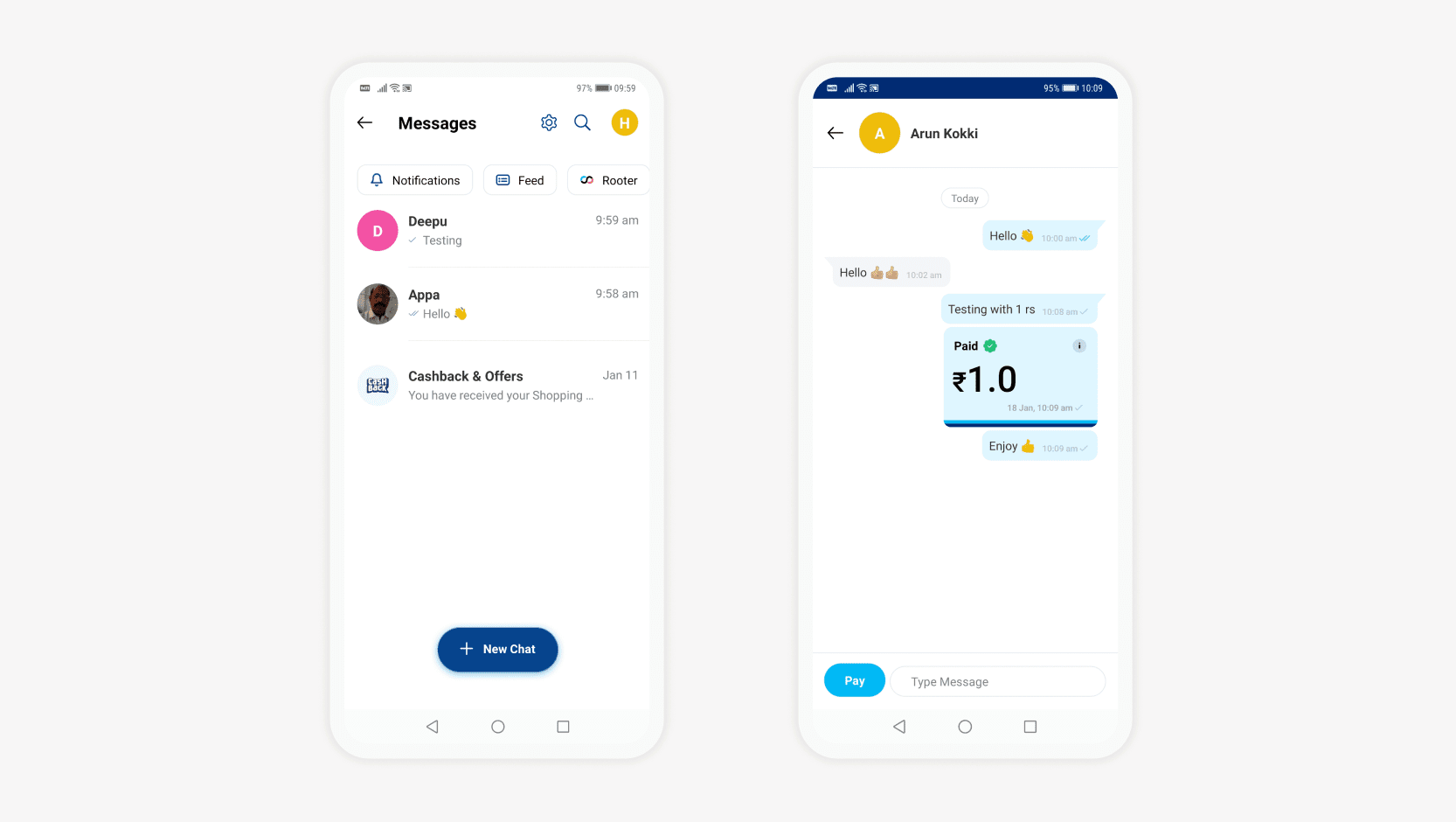

Within the Paytm main app, users can access a messages section Madan refers to as a “chat-powered payments and engagement platform… and represents a change in how users look at transaction history.” Here, Paytm had invested in an “identities-first approach” where users can tap on a contact’s profile and instantly see a clear view of who they are, conversations discussed, what payments were made when they occurred, and for what purpose. These actions link deeply within Paytm’s money transfer suite and allow for a convenient and rich experience for end-users, entirely contained within the company’s ecosystem.

1) Since day one, Sendbird has partnered with AWS to establish itself as a leading conversation platform that enables a secure, global, and scalable in-app conversation experience. Sendbird is an AWS advanced tier technology partner operating 45+ AWS native services in 9 regions. Thanks to Amazon’s AWS Auto Scaling and Amazon Elastic Compute Cloud services, Sendbird manages massive digital traffic, sending billions of messages monthly. Using Elastic Load Balancing and Amazon Route53 geolocation functions, Sendbird ensures reliable global traffic distribution. Sendbird also leverages AWS CloudFormation to automate the management of its servers in each region efficiently. Lastly, AWS Elasticache and Amazon Aurora allow Sendbird to achieve millisecond latency and data storage for over 300 million monthly active users. Sendbird’s world-class conversation platform architecture and technical foundations are certified by AWS.